It’s an important principle since it helps financial statements show the truth of what happened during certain accounting time frames and prevents accounting information from being delayed or accelerated by cash flow. In most cases, these are periods where the transactions actually occur as opposed to when cash is deposited into a company’s account. The accrual principle states that all accounting transactions should be recorded during appropriate accounting periods. Let’s break down some of the most important accounting principles to know and adhere to. It’s always a good idea to make sure your company adheres to the GAAP if you ever want to be traded publicly and if you want other businesses or shareholders to trust your financial statements. rules and standards that are issued by the FASB or Financial Accounting Standards Board.accepted industry practices for accounting.

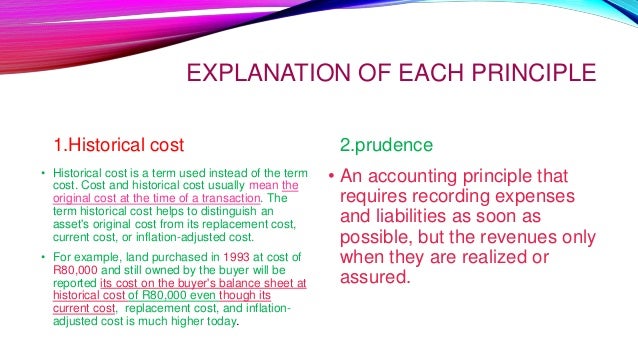

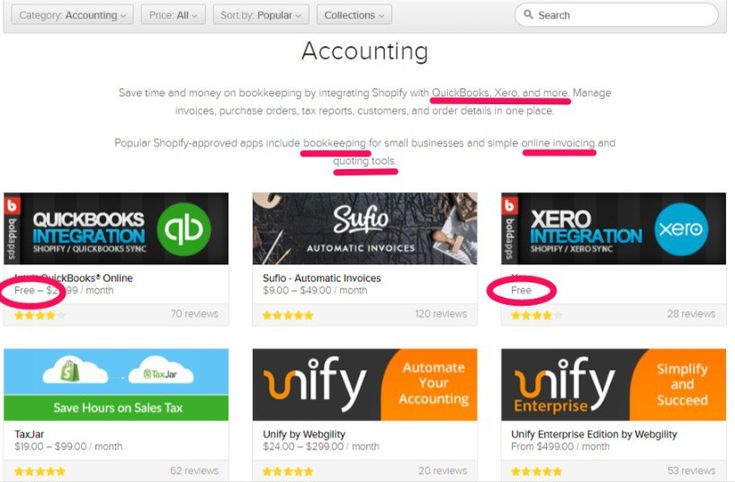

a collection of basic accounting principles and guidelines.If accounting principles help accountants navigate accounting tasks through general rules and guidelines, the GAAP is a kind of standardized list of accounting principles that are commonly understood and adhered to by legitimate businesses or organizations. Even privately held companies and many nonprofit organizations are sometimes required to be GAAP-compliant if they want to qualify for certain loans. The GAAP serves as a good benchmark collection of accounting principles that most companies will follow when practicing good accounting in general. In other words, companies that want to be economically successful in the US and trade on the stock market must abide by the GAAP. In a nutshell, the so-called “ generally accepted accounting principles ” are a collection of accounting principles and standards that any publicly traded companies in the US have to comply with. Accountants these days are taught many of these principles in order to perform their accounting work accurately.įurthermore, businesses and organizations must typically adhere to accounting principles both to make sure they accurately keep track of their books and to make sure they do business legally without the risk of fraud. What Are Accounting Principles?Īccounting principles are collections of accounting practices that, over time, have been developed and standardized through common usage. Let’s break down the 14 basic accounting principles you should know now.

It’s important to know about these basic accounting principles if you want to adhere to stock market regulations and to remain transparent with your shareholders. Perhaps more importantly, basic accounting principles are upheld by accountants and law-abiding businesses throughout the United States. They help businesses to maintain accurate records and ensure a low risk of financial recording mistakes.

It prevents small errors from compounding over time and eventually leading to serious financial strain, and it can help companies make corrections from unsound business practices to avoid bankruptcy.įurthermore, good accounting can help businesses find ways to succeed and thrive, even in tough economic conditions.Īccounting principles are crucial tenets of proper accounting practices. Accounting can be thought of as the immune system for any business.

0 kommentar(er)

0 kommentar(er)